(PDF) Investment_Bodie Kim Luyến Nguyễn Thị Academia.edu

Text & References: 1. Investments, by Bodie, Kane and Marcus 2. Modern Portfolio Theory and Investment Analysis, by Elton and Grubber 3. Investment Analysis and Management, by Charles P. Jones 4. Security Analysis and Portfolio Management, by S. Kevin

Kunci Jawaban Bodie Kane Senang Soal

Investments ZVI BODIE Boston University. ALAN J. MARCUS Boston College THIRTEENTH EDITION Final PDF to printer. bod12665_fm_i-xxviii.indd iv 09/02/22 11:07 AM INVESTMENTS, THIRTEENTH EDITION Published by McGraw Hill LLC, 1325 Avenue of the Americas, New York, NY 10019.. Alex Kane holds a PhD from the Stern School of Business of New York.

Bodie 11e PPT Ch01

investment to be made on each of the stock is calculated according to the model. The study reveals that three industries occupy a hefty chunk (65.78%) of the proposed investment portfolio.. (Bodie, Kane, & Marcus, 2009). According to Sharpe's model, a single value, known as the cut-off rate, measures the desirability of including security in.

Investments 9th Canadian Edition, by Z. Bodie, A. Kane, A. Marcus, L. Switzer, M. Stapleton, D

The market-leading undergraduate investments textbook, Essentials of Investments by Bodie, Kane, and Marcus, continues to evolve along with the changes in the financial markets yet remains organized around one basic theme—that security markets are nearly efficient, meaning that you should expect to find few obvious bargains in these markets. This text places great emphasis on asset.

Chapter 9 Bodie Kane Marcus Investment 9th edition_word文档在线阅读与下载_免费文档

INVESTMENTS | BODIE, KANE, MARCUS 5-7 Taxes and the Real Rate of Interest • Tax liabilities are based on nominal income -Given a tax rate (t) and nominal interest rate (R), the real after-tax rate rate of return is: • As intuition suggests, the after-tax real rate of return falls as the inflation rate rises. t)

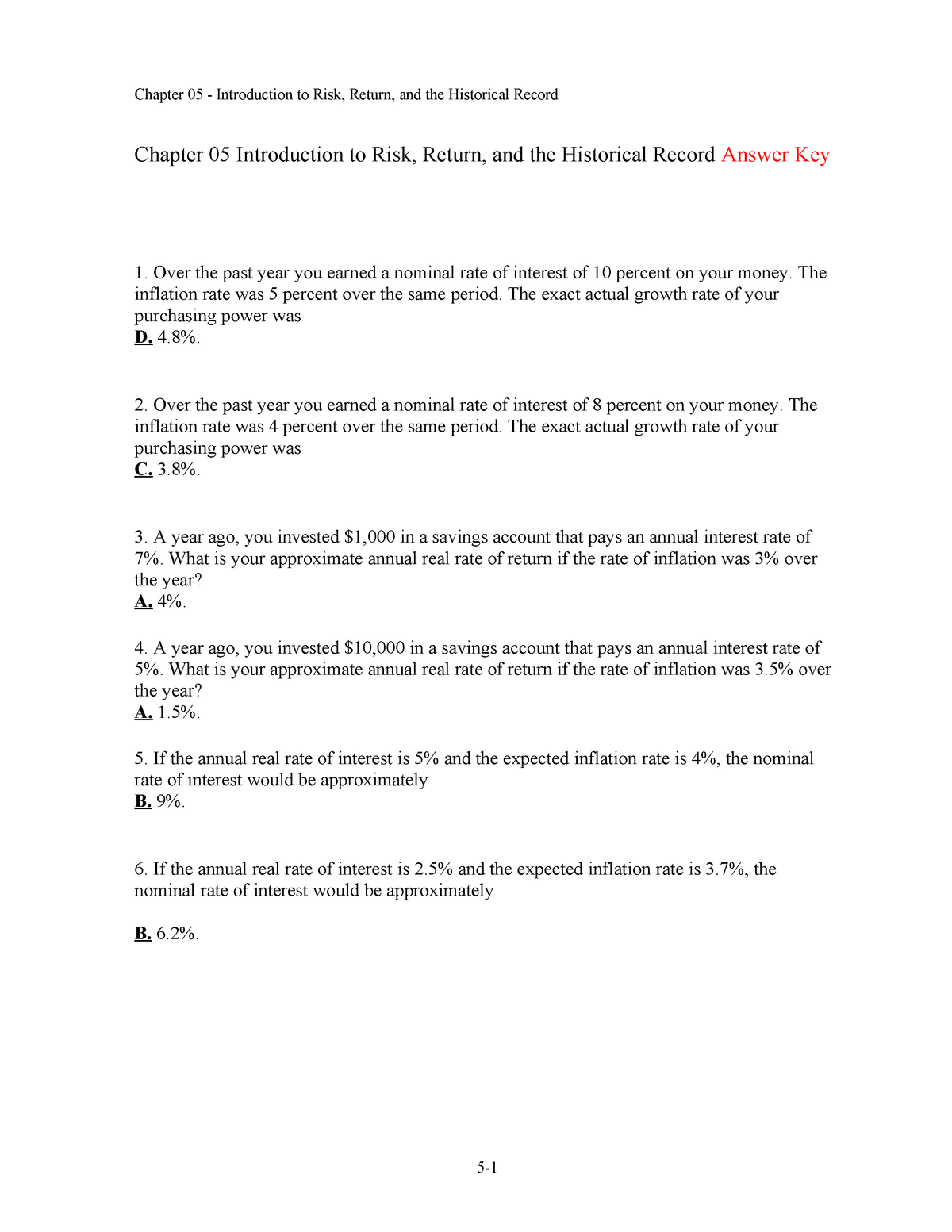

Book solutions chapter 5 essentials of investments zvi bodie alex kane alan j marcus Chapter

Bodie, Kane, and Marcus Essentials of Investments Eleventh Edition 2.1 Asset Classes Fixed Income Securities: Debt securities-Money Market securities: short term debts-capital market securities : Financial asset long term debt :bonds classes. Equity (common stocks) Derivatives: option and future contracts

Pdfcoffee notes from bodie kane ,marcus 1 The investment Environment 2 Asset Classes and

6 Efficient Diversification Bodie, Kane, and Marcus Essentials of Investments Eleventh Edition f 6.1 Diversification and Portfolio Risk • Market/Systematic/Nondiversifiable Risk • Risk factors common to whole economy • Unique/Firm-Specific/Nonsystematic/ Diversifiable Risk • Risk that can be eliminated by diversification

INVESTMENTS 投资学 (博迪BODIE, KANE, MARCUS)Chap015 The Term Structure of Interest Rates.ppt

Chapter 1: The Investment Environment - This chapter now addresses Fintech and cryptocurrency. Chapter 2: Asset Classes and Financial Instruments - The material on the LIBOR scandal and proposed replacements for the LIBOR rate that may be implemented in the next few years has been updated.

1_Investments_Bodie_8th_Edition,slides_word文档在线阅读与下载_无忧文档

INVESTMENTS | BODIE, KANE, MARCUS 6-19 The Risk-Free Asset • Only the government can issue default-free bonds (caveats). -Risk-free in real terms only if price indexed and maturity equal to investor's holding period. • T-bills viewed as "the" risk-free asset • Money market funds also considered risk-free in practice

Investment Bab 7 Bodie Kane Marcus PDF

FIN 4530. INVESTMENTS. Powerpoints. From the BODIE/KANE/MARCUS website Chapter 1; Chapter 2; Chapter 3; Chapter 4; Chapter 5; Chapter 6; Chapter 7; Chapter 8; Chapter 9; Chapter 10; Chapter 11

15minute lesson derivation of optimal risky portfolio (investment b…

7.1 The Capital Asset Pricing Model: Assumptions. Investor Assumptions. All investors are price takers. Investors plan for the same (single-period) horizon. All information relevant to security analysis is free and publicly available. Investors are efficient users of analytical methods investors have homogeneous expectations.

【pdf】投资学 第十一版 博迪 Investments 11th by Zvi Bodie 金融学(理论版) 经管之家(原人大经济论坛)

ࡱ > ! " r u t s r q p n F { B N JFIF dd Ducky d Adobed X ! 1A Qaq " 2# B R br3$ 6 Ct%5u S 4T &v cs DE ҃ d e'7 ӔU VW ! 1A Qaq "2 BRr#3 4 bs $5 CS %T ? Z @m Q :/ l m XM @SL Dx TrU ) k sRU {+ rfW Q W R1ZQ; J c -q E k R (I H3 35V)Uy և* N@g UQָ# Qଵ :m G # G "y % )sM W#E I T 9 B@ʘZ (( Zx U% J h4\ Z G # Ќ + ( 5 ;i i I . 1

Bodie Essentials of Investments 12e Chapter 05 PPT

Investments: Background and Issues Bodie, Kane, and Marcus Essentials of Investments Eleventh Edition 1 Introduction - What is an Investment Definition. Current Commitment vs. future Benefits. Sacrifice today vs. benefit in the future. Types of Investments. Investing in education. Investing in securities. Financial Investment - Commitment.

Investment chapter01 Bodie,Kane,Marcus_word文档在线阅读与下载_文档网

11. INVESTMENTS | BODIE, KANE, MARCUS • Fundamental analysis • Assessment of firm value that focuses on such determinants as earnings and dividends prospects, expectations for future interest rates, and risk evaluation • Seeks to find firms that are mispriced • Attempt to find firms that are better than everyone else's estimate or troubled firms that may be great bargains • EMH.

bodie kane marcus investments 12th edition pdf trentonmezquita

We would like to show you a description here but the site won't allow us.

(PPT) INVESTMENTS BODIE, KANE, MARCUS ©2011 The McGrawHill Companies CHAPTER 20 Options

INVESTMENTS | BODIE, KANE, MARCUS. ©2021 McGraw-Hill Education 5-14. f Risk and Risk Premiums: Excess Returns and Risk Premiums. • Risk premium is the difference between the. expected HPR and the risk-free rate. • Provides compensation for the risk of an investment. • Risk-free rate is the rate of interest that can be.